Australia labour market update 2023

For our first edition of this year, we dug into the latest employment data to forecast key trends in 2023 that business leaders and hiring managers in Australia should be aware of.

Our headline finding is that although a cooling economy is likely to temper the red-hot labour market, many of the recruitment challenges faced by companies will persist. In this context, leveraging remote and offshore talent should remain a key part of their human resource strategies.

The labour market is settling but remains tight

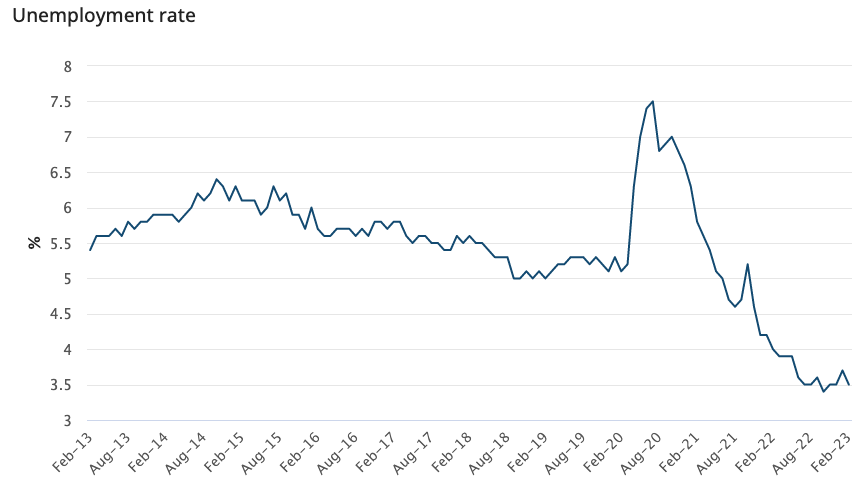

According to the latest data released by the Australian Bureau of Statistics (ABS), the unemployment rate continues to hover at 3.5%, where it has been since August 2022, after falling continuously during the first half of the previous year. And while employment growth essentially levelled out in February, there was still a net addition of 19,800 jobs compared to the previous month.

Does this mean the labour market is starting to ease, and that hiring is about to become easier? Past data suggest otherwise. Although the central bank forecasts that the unemployment will rise to 3.8% by the end of this year, that would still be close to a historically low level. As the figure below shows, during the pre-pandemic period of 2013-20, the unemployment rate never went below 5%, and reached as high as 6.4%. Therefore, Australia’s talent shortage is unlikely to disappear anytime soon.

Australia Annual Unemployment Trend, 2013-23

Key findings for human resource planners

Beyond the broad state and future direction of Australia’s labour market, we looked at the February Labour Market Update by Jobs and Skills Australia (JSA). This helped us unpack the data and identify the most pressing issues companies will likely be dealing with in 2023, from a recruitment and human resource planning perspective. Four factors stand out in particular.

Finding # 1: High turnover remains a big problem

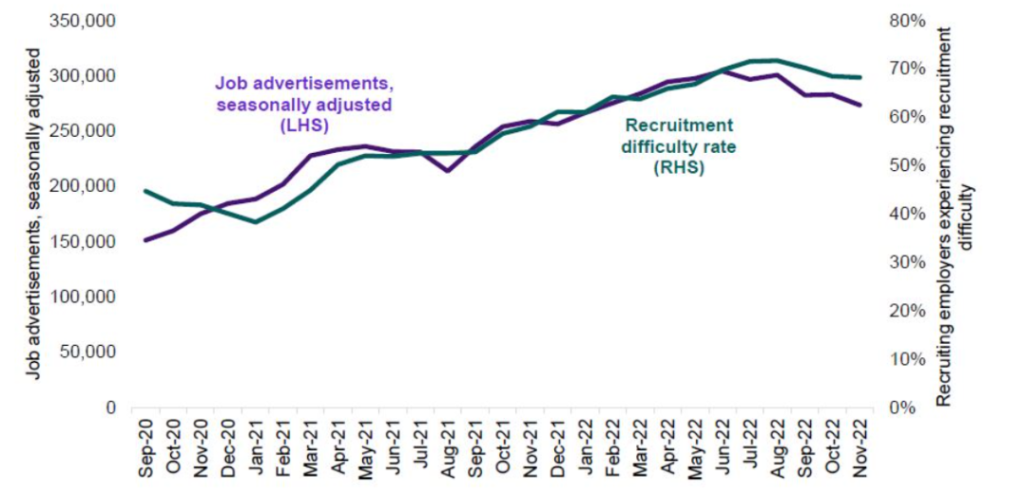

Recruitment activity seemed to have slowed somewhat by the end of 2022. As measured by the JSA’s Internet Vacancy Index, the number of job ads declined by 3.5% in the last quarter, and stood at 272,500. Nevertheless, this remains far higher than pre-pandemic levels: in the decade leading up to 2020, monthly jobs ads crossed 200,000 only once, in 2011.

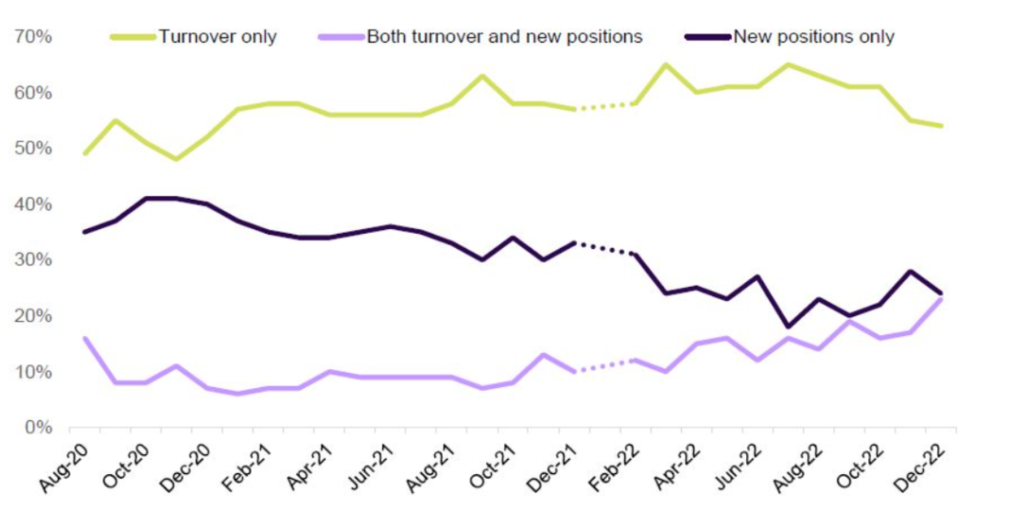

The persistence of relatively high recruitment activity can partially be explained by the main reason for ongoing hiring. This remains turnover, which according to JSA, was the reason for 54% of employers to be recruiting in December, 2022. By comparison, only 23% were doing so for both turnover and new positions. Given that Australia’s talent shortage remains acute, retaining workers – increasingly in remote settings – is critical.

Reasons for Recruitment

Finding # 2: Payroll costs will keep growing

As companies plan for their resourcing needs in 2023 and beyond, they should factor in continuing overall wage growth in Australia.

According to the Federal Budget released in October 2022, the Australian Treasury forecast annual nominal wage growth of 3.75% until 2024. Estimates using actual market data are even higher. Based on a salary index created from listings of an online jobs market place, the annual growth in advertised salaries during 2022 was estimated to be 4.7%, and expected to be higher still in 2023.

Given the ongoing strong labour demand in an inflationary environment, these data are not surprising. Faced with inadequate supply and rising costs in the Australian market, employers need to include offshore hiring in their talent strategies, if they aren’t doing so already.

Finding # 3: Filling vacancies remains difficult

Survey data collected by JSA show that in 2022, a whopping 54% of employers had unfilled vacancies for more than a month.

This underscores the fact that, while recruitment difficulty eased marginally in the last quarter of 2022, it remains quite high. The estimated recruitment difficulty rate was around 70% at the end of last year, and has been rising steadily since the start of 2021, when it was close to 40%. This is confirmed when looked at the other way. The average rate of filling jobs was 65% in 2020, but dropped to 57% in 2022.

Job Advertisements and Recruitment Difficulty

Furthermore, employers in regional areas are consistently having more trouble filling roles compared to those in capital cities, whose job fill rate and applicant per role remained lower throughout 2022. These companies, in particular, could benefit from exploring remote and offshore-based talent solutions.

Finding # 4: The skills shortage persists

The last insight we think employers need to be aware of is the strong empirical evidence showing that the higher the skill level, the more difficult it remains to fill in the Australian economy.

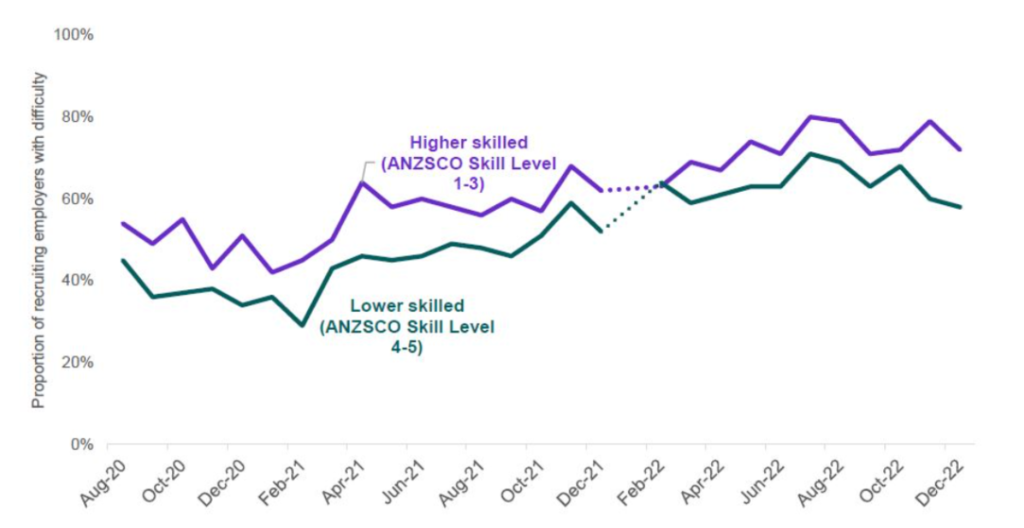

Considering demand first, the annual change in the JSA’s Internet Vacancy Index for 2022 was highest for jobs requiring a Bachelor’s degree or higher, at 11.7%. All other categories with lower educational attainment levels had lower growth rates. At the same time, on average, recruitment difficulty for more skilled workers has been consistently higher than lesser skilled ones, over the last two years.

Recruitment Difficulty by Skill Level of Occupation

Again, companies need to be proactive in responding to this, which is likely to remain a long-term structural problem for Australia’s labour market. With remote work becoming entrenched in the post-pandemic era, employers should explore emerging markets with a growing surplus of skilled professionals.

How Bettersource can help

We help our clients overcome their recruitment challenges by providing them access to top quality remote global talent. Our on-ground recruitment teams in offshore markets identify the best professionals.

With flexible solutions, ranging from distributed teams to dedicated offshore centres, we build high-performing teams for clients across finance, energy, retail, and more. From recruitment, onboarding, training, and HR support, our end-to-end model is built to fulfil any organisation’s growth needs.

Have questions? We would love for you to get in touch. Simply register to start browsing our pre-vetted remote talent pool. One of our dedicated engagement managers will then guide you through the rest of the process.